Delivery Challan Format Pdf

Challan 280 or Challan ITNS 280 is Income Tax Department form used for payment of Income Tax, Advance Tax, Self-Assessment Tax and Corporation Tax. Features of Challan 280 form compiled by Karvitt. Income Tax Challan 280 in Excel and Fillable PDF formats have built in formulas for auto totalling, auto filling of counter foil and auto writing of. Delivery Challan Format. Delivery challans must be serially numbered not exceeding sixteen characters, in one or multiple series. The following information must be mentioned in all delivery challan formats: Date and number of the delivery challan. Name, address and GSTIN of the consigner, if registered. The Format of a Delivery Challan Transportation of goods require issuing of Delivery Challan; Goods sent on approval basis,where the goods being sent or taken within the State or outside the State on approval for sale or return basis and are removed before the supply takes place, Challan should be issued at the time of removal of goods. Income Tax forms: Download Income Tax Challan and other commonly used forms in Excel / in Fillable PDF format. GST RFD 01A: Download GST RFD 01A Refund Application (Manual) in Fillable PDF format. Please use a separate challan for each type of payment. Please note that quoting your Permanent Account Number (PAN) is mandatory. Please note that quoting false PAN may attract a penalty of Rs. 10,000/- as per section 272B of I.T. Please note that to deposit Appeal Fees either Major Head 020 or 021 (depending upon the tax. Delivery Challan Format for Ordered Items Free Download Sample Delivery Challan Format in Excel and Word files are available for free download. This Challan normally used when purchase orders and product supplies are delivered to any person or company. This document considered as proof of delivery with signature of receiving and delivering person. However, a delivery challan & tax invoice can be combined together to form “delivery challan cum tax invoice.“ Delivery Challan Format. After all this information about the delivery challan, you must be looking out the formatting or the contents of the delivery challan. Here are the most critical aspects that must be included in a delivery.

As an enterprise or logistics head, does the question on delivery challan arises in your mind too? Then this article will provide all the answers to your question right from the beginning.

The scope of this content includes Microsoft solitaire offline windows 10.

What is a Delivery Challan?

Delivery challan, slip of delivery or dispatch challan, is an instrument that carries details about the delivered goods such as quantity, condition and description. This challan also contains the recipient details, delivery location and time. The principal purpose of delivery challan is transfer of goods.

Normally, three copies of Delivery Challan are generated:

- First for the Buyer

- Second for the transporter

- Third for the Seller

It shall be noted that delivery challan is communicated with the transported goods. It is an important document that is used by nearly by every business for a day-to-day transaction.

Difference between Invoice and Delivery Challan

What is the difference between an invoice and a delivery challan? Is the most common question that pops-up in the mind, as their functionalities are pretty much same

| Particulars | Delivery Challan | Invoices |

|---|---|---|

| Meaning | A delivery challan/slip or note helps to acknowledge that goods are received or accepted by the customer. It does not transfer any legal ownership or rights. | An invoice or bill is a document through which the customer accepts the full-ownership, along with risk, rights and liabilities of the goods. |

| Contents | Quantity, condition and description of goods | Quantity, description, GST rate, HSN code and amount payable |

| When to send? | When goods are dispatched | At the time of dispatching of goods |

| Accounting entries | Cannot be used for making entries in the books of account. | Provides a base for entries in the books of accounts. |

| Acknowledgement | It shall be acknowledged by the recipient or customer. | The customer or recipient need not to acknowledge. |

| Taxable value of goods | Taxable value of goods | An invoice contains the taxable value of goods. |

However, a delivery challan & tax invoice can be combined together to form “delivery challan cum tax invoice.“

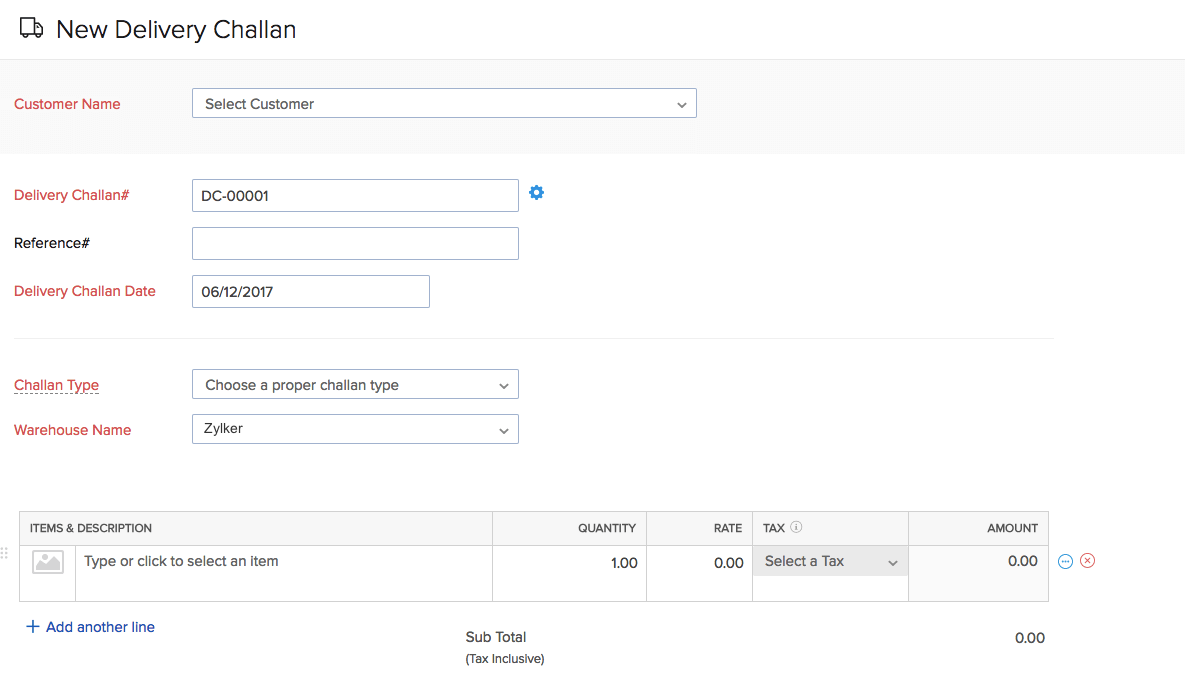

Delivery Challan Format

After all this information about the delivery challan, you must be looking out the formatting or the contents of the delivery challan. Here are the most critical aspects that must be included in a delivery challan.

Material Delivery Challan Format Pdf

- Delivery challan date

- Delivery challan’s serial number

- Registered supplier’s name

- Buyer’s name and identity

- The quantity and the details of the goods, along with their HSN codes

- The name and address of the transporter or consignor

- Delivery Place

- Signature

To make an errorless challan, capture the fine details of the goods such as their taxable value, description, HSN code.

It shall be noted that delivery challan serial number is mandatory as it helps in its identification and makes it easier for future references. Moreover, in a case, if the person who is receiving such goods is unregistered, the place of a business must be clearly specified in a delivery challan.

When to issue a Delivery Challan?

You must be probably striving for a resolution to this question. These are the situations that impel you to generate a delivery challan:

- In a situation where the business place of a supplier is not disclosed to the person receiving such goods

- Supplying goods on approval basis

- To transport job work goods such as machinery, dices etc.

- The number of goods cannot be determined at the time of dispatch (e.g. Liquid gas)

- Transportation of semi-assembled goods or completely in parts

Delivery Challan Download

Under any of these scenarios, a delivery challan can be generated and issued.

The Conclusion

Delivery Challan Format In Word

Book or record-keeping is a vital culture among successful enterprises, as they maintain proper records of each and every important document. One such document is a delivery challan.

Further, you can create and generate an errorless delivery challan, invoices and sales or purchase order in a few clicks, using auTotax GST software. In addition to this, autoTax helps you to automate all your GST compliances as it can be integrated with all the leading ERPs easily.